Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

Ever since the first TV viewer quintile studies were conducted in the 1960s, media planners and their clients have been wringing their hands about the "problem" of the imbalance in TV viewing, with some people watching much more often than others. Specifically, the typical quintile tabulation shows that one fifth of all TV home residents account for about half of all viewing while, at the opposite extreme, the lightest viewing fifth does only 2-3% of the viewing. As a result, a brand that puts most of its ad budget into TV is "overexposing" some people to its commercials while "underexposing" others. In fact, the lightest viewing fifth likely sees only a few, or even none, of its commercials during the course of a year. Since the demographic breakdowns invariably reveal that the largest proportion of the light viewing group are young adults and those with above average incomes or educations, this is seen as a huge marketing problem. But is it, really?

To redress the imbalance of viewing, agency clients frequently ask whether their media buyers can focus their TV buys on shows targeting light TV viewers. But there are very few shows that tilt in this direction because they can't pull acceptable ratings and are soon cancelled. Even if one tries to use cable channels like MTV, Comedy Central, etc., which have relatively high young adult audience comps, it turns out that many of these younger viewers aren't in the lightest TV viewing quintile but rather are in the more moderate viewing groups (quintiles 2-4).

There are also trade-offs to consider. What is the result if you divert ad dollars to increase the representation of light viewers by trimming off those shows with an excessive appeal to heavy viewers? The answer is that for every ad exposure gained among the light viewers (and usually we're talking about one exposure per month at best) many times that number of exposures is lost among heavy viewers. In other words, "share of voice"—the share of ad impressions relative to those of competing brands—drops significantly, to enable a small gain among light viewers. And will light viewers even be attentive to that solitary commercial that they bump into over the course of 4-8 weeks? Based on their younger demographic skew, aren't light viewers more likely to leave the room and or otherwise be inattentive during that single opportunity to sell them on the merits of your brand? According to TVision's webcam surveys, young adults are more likely to avoid commercials than older ones. Wouldn't that axiom also apply to the heavy and light quintiles?

It is often suggested that the "solution” is to utilize a different media mix, with the TV component reduced in favor of audio or print media, which reach lighter TV viewers at reasonable CPMs. But many advertisers think audio and print ads are not as effective as TV commercials, so that belief—accurate or not—nixes this option. Streaming TV is another alternative, but its CPMs are higher than cable, and while young adults are more heavily represented than in linear TV audiences, they are not the dominant viewer segment.

So, let's turn our attention to the marketing side of the equation. As we have pointed out in other MDI Alerts, for many brands only about 15% of sales results can be attributed to their ads, and studies rarely show a figure higher than 25% (with the exception of new product launches at the outset of their campaigns). Other factors such as distribution, word-of-mouth endorsements, pricing, and product quality are at play; it isn't necessarily essential for a consumer to see a TV commercial to register a sale.

Decades ago, we used Simmons data to examine hundreds of brands that spent 65-85% of their ad dollars on national TV. We tallied buyers of each brand by viewing quintiles and found that each of these brands had the light viewer "problem" we have articulated in this report, yet their shares of market were amazingly consistent across all five quintiles. Why weren't the light viewers way below par in their brand choices for these heavy TV spending brands?

We repeated this analysis about 10 years ago, this time using MRI data, and essentially found the same results. However, with TV rating fragmentation, cord cutting and the rise of streaming, perhaps things are now different. So last year we conducted another analysis, this time using the MRI-Simmons USA combined Spring 2023 database of 50,000 respondents. Again, we started with a quintile tally, including both linear and streaming viewing. Once again, familiar patterns emerged.

In terms of demographics, 58% of the heaviest viewers were aged 55+, whereas only 18% were 18-34s. In contrast, the 18-34s constituted 44% of the lightest quintile, while the 55+ segment accounted for a mere 20% of these chronic TV abstainers. The other demos fell neatly in line. The heaviest viewers were mostly not employed (60%), had educational levels of high school or less (49%), and household incomes under $50,000 (43%). The corresponding percentages for light viewers were 30%, 36% and 30%.

For this analysis we selected 50 heavy spending TV brands from a wide assortment of product classes and tabulated their brand purchase claims among product category users by TV viewing quintile. The average result is shown in the accompanying table: once again, there was virtually no difference between brand preference among heavy, moderate and light viewing product users. The average brand fared only 3% better than its overall norm among heavy viewers and only 7% below among those who rarely if ever see its commercials.

How can an advertiser apply these findings? First and foremost, before coming to any conclusions about a specific brand, it is wise to repeat our analysis for that brand specifically and trend the findings using past studies. Perhaps your brand is an exception. Perhaps some quirk of distribution, demographic appeal or pricing is causing a departure from the average result. In which case you may want to consider creating a more balanced ad exposure situation by any means that seems reasonable, including the use of media that haven't been employed before.

However, if your brand looks like those averaged in our table—and the same applies for competing brands—then the heavy versus light viewer "problem" may not be a problem at all. What may be happening is that advertising share of voice is causing the competing sales pitches among heavy viewers to cancel out each other, leaving factors such as pricing and distribution to play out their roles in motivating sales. In such a situation, drastic reductions in share of voice might cause loss of overall media exposure weight to such an extent that any small gains made among light viewers are nullified when the big picture of total sales is considered. It’s also possible that competing brands are in the same boat, which means options other than TV (e.g. social media or sales promotion activities like point-of-sale lures or product sampling) might work better than trying to tweak heavy versus light viewer exposures. In short, it’s not just the media numbers that must be considered.

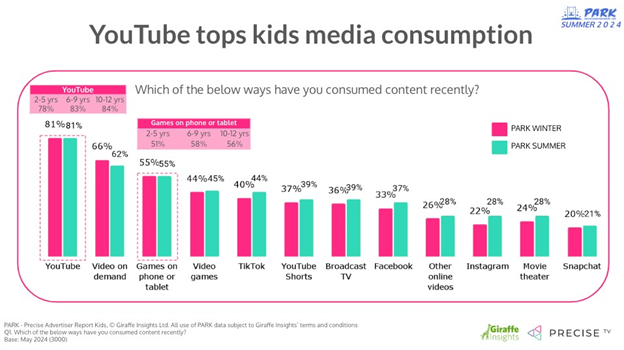

So often in discussions about streaming, the focus is on SVODs like Netflix, Hulu, and Disney+, as well as linear streaming platforms like Peacock and Paramount+. But what about YouTube? In Nielsen’s latest The Gauge report (May 2024), YouTube had a 9.7% share of streaming viewing, followed by Netflix at 7.6%, and all the others coming in at 3% or less. Furthermore, in Precise TV’s latest PARK study (Precise Advertiser Report – Kids), they reported that 81% of kids (aged 2-12) used YouTube for media content, 15 percentage points above the runner up, video-on-demand.

So, given YouTube’s dominance in the market among adults, as well as the fact that kids turn to YouTube for their content, why doesn’t it factor more largely in discussions about streaming and the future of “TV”? It’s a question worth pondering.