Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

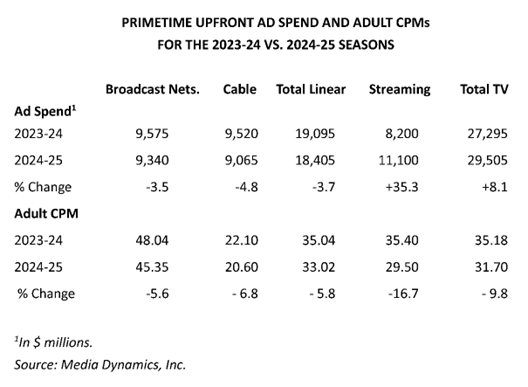

After many weeks of sometimes intense negotiations, the bulk of the 2024-25 season's primetime TV ad sales have been completed for linear TV and streaming venues. The good news is that ad spending for both sectors combined was up from $27.3 billion this season to $29.5 billion next season, an increase of 8%. However, all of this gain was attributed to streaming, which posted a 35% increase, while linear TV was down by 4%. Nevertheless, linear didn't do all that badly—compared to what some were predicting—due mainly to gains scored by its sports attractions.

The most interesting development concerned shifts in CPMs, as buyers were determined to wrest significant concessions from linear TV ad sellers for a second year in a row, something that has not happened in recent history. And they seem to have gotten what they wanted: linear adult TV CPMs declined to $43.35 for broadcast and $20.60 for cable, declines of 5.6% and 6.8%, respectively. But the big news regarding CPMs was evident in streaming, where buyers were firm in their resolve to pay CPMs that were more competitive with linear TV norms, something they hadn't focused on as much previously. This called for tougher negotiations with the high-priced sellers and a shifting of dollars to FASTS and Amazon or YouTube, all of which offered more favorable CPM pricing options. As a result, while streaming's ad revenue rose by 35%, its average CPM for a 30-second message declined by 16.7%, which partially offset its major ad revenue gains.

Net, net, the buyers wrangled an overall CPM reduction of about 10% in their combined linear TV and streaming buys, but spent 8% more to get it. A not so ugly trade-off in our opinion.

It should be noted that the upfront extends well beyond primetime and includes national syndication buys as well as ad spending for various dayparts: early AM, daytime, early news, late night, etc. on the broadcast TV networks and cable channels. Altogether, about $45-50 billion is spent in upfront buys for national TV advertisers of one kind or another, which leaves only about $10-12 billion remaining for scatter deals.

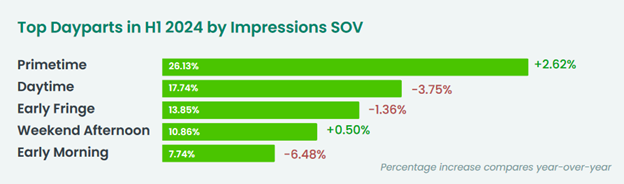

iSpot.tv’s latest TV Transparency Report for the first half of 2024 emphasizes the point we made in our upfront/CPM findings for 2024-25, specifically that TV is not just about primetime. Per the report, while primetime continues to hold the lead, with a 26% share of linear ad impressions, daytime follows with an almost 18% share, followed by early fringe at nearly 14%. To put it another way, almost 74% of linear TV’s share of viewing falls outside of primetime. Furthermore, iSpot.tv’s top 20 programs by share of ad impressions included syndicated comedies (Friends, The Big Bang Theory), morning shows (Good Morning America and Today), plus long-running programs like The Price Is Right, The View and The Young & The Restless. We have always emphasized the public’s appetite for such programming; it’s not glamorous, but it’s where the eyeballs are. And it’s an important point to remember amid the hype for primetime at the close of this year’s upfront.