Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

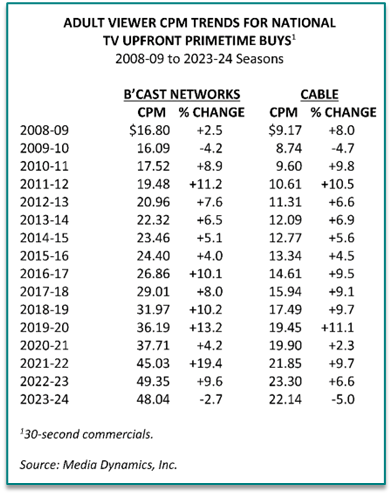

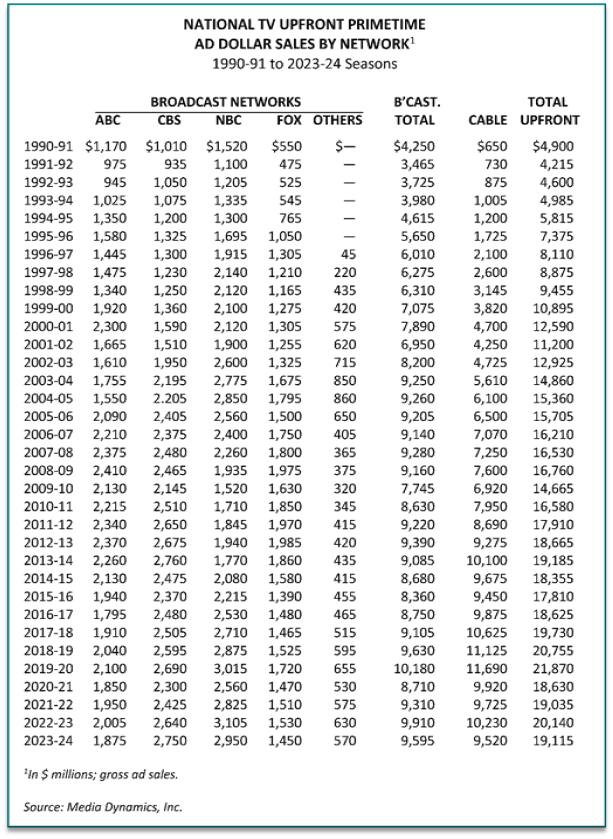

The primetime upfront time sale for national TV's 2023-24 season witnessed some losses for the broadcast TV networks and cable channels in both total ad spending and CPMs; however, these losses were largely offset by the performance of the streaming sector's ad-supported services, which posted strong gains. Specifically, the broadcast TV networks, in aggregate, were down about 3% compared to the previous season in ad revenues, garnering an estimated $9.6 billion compared to $9.9 billion, and their 30-second spot CPMs for adult viewers also dropped by 3%, declining from $49.35 last season to $48.04 in the current upfront. Cable took a somewhat larger hit with a 7% decline in ad dollars ($9.5 billion, down from $9.9 billion) and a 5% reduction in adult CPMs from $23.30 last year to $22.14. All told, the combined broadcast network and cable linear TV upfront wound up with ad revenues of $19.1 billion, down 5% from the previous season's $20.1 billion.

The good news for streaming—and the linear TV companies that own ad-supported streaming services—was strong gains posted by many FAST and AVOD services. Their time sales increased 31% from $6.1 billion last season to $8.0 billion in the just completed upfront. As a result, the combined linear and streaming upfront saw streaming's gains wipe out all of linear's losses. The overall tally, counting time sales for both platforms together, was actually up slightly with the 2023-24 upfront garnering $27.1 billion compared to $26.3 billion for the 2022-23 season.

A number of factors were at play in this year's upfront. Many advertisers were concerned about where the economy was headed, while time buyers were recognizing the loss of coverage by cable channels due to continued cord cutting. So, despite cable's huge CPM advantage over both broadcast TV and most ad-supported streaming services, there was a feeling that cable's continuing loss of reach due to cord cutting was an issue that had to be dealt with, especially by those advertisers whose prime sales prospects were mainly in the under 50 age category since older skewed broadcast TV was not where such lost viewers could readily be found. The buyers were also determined not to pay anything approaching the huge CPM hikes that the sellers scored in the past two years. Also on their minds was the impending writer's strike, which meant that many of the seller's primetime program schedules would be filled by "non-scripted" content of lesser quality. So, this was the time for them to demand lower CPMs, with the modest exception of certain types of sports.

MDI president, Ed Papazian, observed, "What we’re witnessing is both forms of TV content access—linear and streaming—coming together in the thinking of major national TV advertisers and their time buyers. TV is no longer thought of as being simply a combination of broadcast TV and cable, with various dayparts and program genres to meld together into a total TV buy. Now, streaming has come of age, with sufficient scale to be considered a third alternative, which is why the FAST and AVOD services scored sizable ad revenue gains despite their high CPMs. It's all TV now."

As for other upfront time buys, mainly involving the early AM, daytime, and early and late evening needs of national brands, these amounted to about $10-12 billion. All in, the upfront—including national syndication sales and the broadcast networks, cable and streaming—amounted to about $37-40 billion, which means that as in previous years a massive amount of national TV ad spend is locked up in upfront buys, many of which are not brand-specific but reflect the combined requirements of all of the brands in the advertisers' corporate stables. This greatly limits the degree of audience targeting that is realistically possible for each brand, as one way or another, CPMs still rule in huge volume discount buys, even in a flat or slightly down year like the current one.

Additional detailed breakdowns of primetime upfront ad revenues, comparisons of how the major broadcast networks fared and recent CPM trends are shown in the following tables.